Investing in Your Future: Build Your Company in Financial Comfort

The power of living below your means and investing the right way.

Creating Financial Comfort through Investing.

I’m in a position where I can build my company slowly and comfortably. This is only possible because of how I lived my life during my 20s. You’ll leave this article with:

an understanding of the long-term benefits of living below your means

an argument to consider investing your money, if you aren’t already

my investing strategies

Subscribe below to continue learning from my experiences as a founder through weekly 10-minute reads.

Living Below Your Means.

Saving money (“living below your means”) and investing it leads to long-term financial comfort. Let’s look at an example analysis of “John’s” finances.

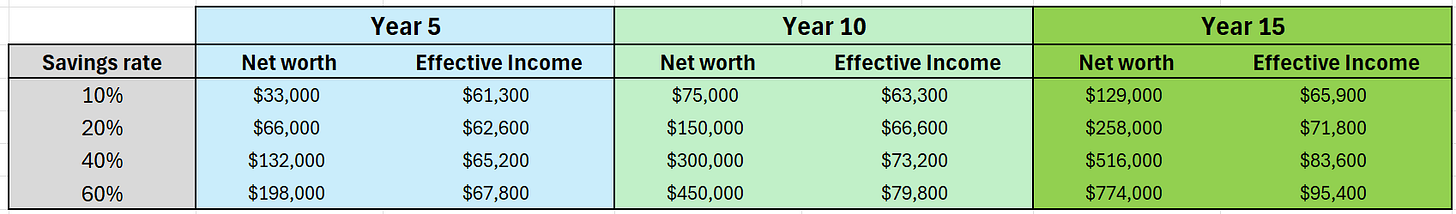

John’s post-tax earnings are constant $60,000 per year. His investments grow at 5% per year (a conservative estimate given historical stock market trends). The table below shows how much money John would have if he had saved and different percentages of his income over 5, 10, and 15 years.

In the table above, John’s net worth is the total amount of money in his accounts. John’s effective income adds together the $60,000 in post-tax earnings and the annual growth of his investment. The annual growth of his investments is approximately his net worth multiplied by the growth rate of 5% per year.

When John saves 60% of his post-tax earnings, he’s effectively grown his income by 60% (from $60,000 → $95,400) in year 15! Or, looking at it another way, because his annual investment income is ~$35,400, his post-tax earnings could go down to $25,600, and he’d be equally well off.1 The more John can “live below his means” when he’s young, the more he can reap the benefits later in life.

In my twenties, I lived below my means. For almost two years I lived (rent-free) at home with my parents, and I never frivolously spent my money. As a result, from when I graduated college to when I turned thirty, I saved well over 50% of my post-tax earnings. I can now build my company from a place of financial comfort. My salary is lower than when I was a full-time employee at larger companies, but it’s offset by the growth of my investments.

There are three types of people who will read this. Which are you?

There are largely three types of people who will read this article:

People who read this and think, “This is obvious, and I’m already doing it.”

People who read this and think, “Investing isn’t for me.”

People who read this and think, “He makes some good points; I’ll try it.”

Most readers will fall into one of the first two buckets. But, please, if you think investing isn’t for you, ask yourself, “Why?” Here are some common reasons I’ve heard:

I don’t know how to invest.

I don’t want to lose my money.

I’m not the type of person who invests in the stock market.

I don’t have money to invest.

You know yourself best, and you should make your own decisions about how to handle your money. However, in my opinion, these are all very solvable problems:

It doesn’t take a lot of knowledge.

You can choose investments that are lower risk (at the cost of lower return).

You are probably the type of person who would be happy to have a passive income of $30,000 per year. If investing can do that for you, why wouldn’t you consider it?

There might be some sacrifices you need to make today to help set “future you” up for success. Consider making those.

Five Principles for New Investors.

I studied Quantitative Finance and Physics at UVA. That was almost ten years ago, so I’m not an investing expert. That said, I’ll share the five principles I learned and followed for my own investing that have helped get me where I am now:

Don’t try to time the market.

Dollar-cost average. At a high level, dollar-cost averaging means putting a fixed amount of money into the market every month. When prices are “high,” you’re putting the same amount of money as you would be when prices are “low.”

Minimize stock picking.

By stock picking, I mean “picking individual companies to invest in.” Investing in individual companies like Google, Apple, Microsoft, or Nvidia would all be considered stock picking. It is fun and sometimes profitable to pick individual stocks, but it often comes with much higher risk than the alternatives I share below.

In general, invest in ETFs or index funds. These are aggregations of individual stocks. They help lower your risk relative to owning individual stocks. For example, if a new device makes the iPhone obsolete, Apple’s stock would plummet. An index fund would be impacted by this too, but the ETF would be less impacted because Apple represents a small percentage of the variety of the many stocks included in the package.

Most of my money is in the Vanguard Total Stock Market Index Fund (VTI).

Pay attention to the “expense ratios” of the funds you pick.

Expense ratios are the amount the fund deducts from your investment growth. The VTI fund I mentioned has an expense ratio of 0.03%. So, if you invest $100 and it becomes worth $110, you will ultimately get $109.997 (Vanguard takes less than a penny). Higher expense ratios typically mean the fund is “actively managed.” This means someone is actively timing the market or stock-picking on your behalf. On average, they’ll charge you more than their skills are worth, and it’s better to find funds with low expense ratios.

Understand and adhere to your own risk tolerance.

There are plenty of lower-risk options out there with decent returns, especially now that interest rates are high. Over long time horizons, on average, the stock market goes up. Over short time horizons, you have to be OK with watching the value of your accounts go down.2 If you don’t think you can handle watching the value of your account wildly swing up and down, pick more stable investments like the Vanguard Bond Market index fund (BND).

Buy and hold.

Not only does the “buy and hold” strategy save you from trying to time the market but when you hold your stocks for longer, you’re taxed at a lower rate. If you invest $100 and the investment grows to $110, the government taxes the $10 growth of your investment. If you hold the stock for less than one year, the capital gains tax can be as high as 30%-40% (you’d effectively get $106 when you sold the stock). If you hold the stock for more than one year, the capital gains tax could be as low as 10%-20% (you’d get $109 when you sold the stock).

To help yourself adhere to these five principles, I’d open an investing account with a company like Vanguard. Other platforms like Robinhood or Etrade encourage you to stock-pick and trade more frequently because that’s how they make money.

Investing in Your Future.

“Past Alek” made sacrifices and smart financial decisions. He lived below his means and intelligently invested the money that he saved. “Present Alek” can now reap the benefits. Today, I've been able to take a lower salary and build my company slowly and comfortably.

If you don’t think investing is for you, that’s fine, but please ask yourself, “Why?” I wouldn’t be where I am now without saving and investing; it’s been a huge boon.

If you do consider investing, also consider these five principles:

Don’t try to time the market.

Minimize stock picking.

Pay attention to the “expense ratios” of the funds you pick.

Understand and adhere to your own risk tolerance.

Buy and hold.

It’s never too late to start. As shown in this article, you can start reaping significant benefits in as few as 5, 10, or 15 years.

Thanks for reading! Questions or ideas for topics? Email me.

The math here is all approximate. If you were actually selling investments to cover your expenses you’d need to pay capital gains taxes as well.

For what it’s worth, for the most part, I don’t even look at what the stock market is doing most days. I check maybe once a month to save myself from the daily rollercoaster ride of +/- 5% swings.